Classifying your products

Learn how to classify your products using the Dutify WooCommerce plugin.

To calculate duties and taxes accurately, your products must be classified. If you do not classify them, Dutify will automatically attempt classification during calculation based on the product title.

Classification options

The Dutify plugin provides new attributes to help with classification. You can classify products using one of the following methods:

- Classification ID - Use Dutify’s Classification ID. This is the most accurate method, as HS codes differ between countries and may change over time.

- HS code - Provide a full or partial HS code for one country. Dutify will then use this (along with the product title) to classify your product for other countries.

- Note that accuracy may vary when using HS codes.

- Managed classification – Dutify’s classification experts can classify your entire catalog on your behalf. This service is billed separately from your subscription. Contact us for more information.

- Product title - Is the fallback if no classification is provided.

We recommend using Classification ID to guarantee calculations are accurate.

Where do I find classification IDs?

Classification IDs can be retrieved in a number of ways:

-

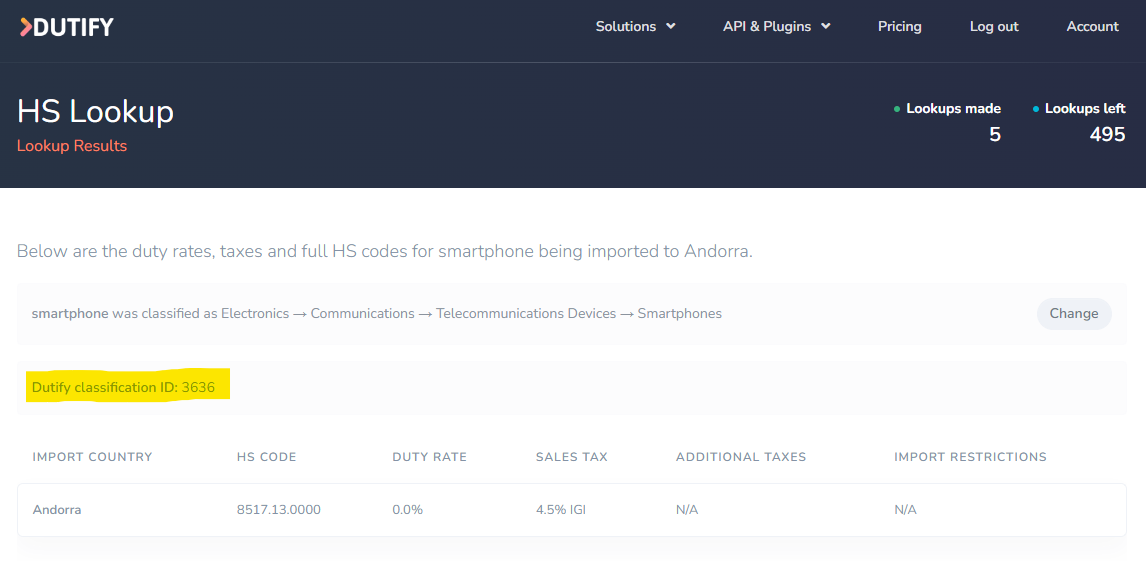

Search for a product using our HS Lookup tool, the ID can be found on the results page:

-

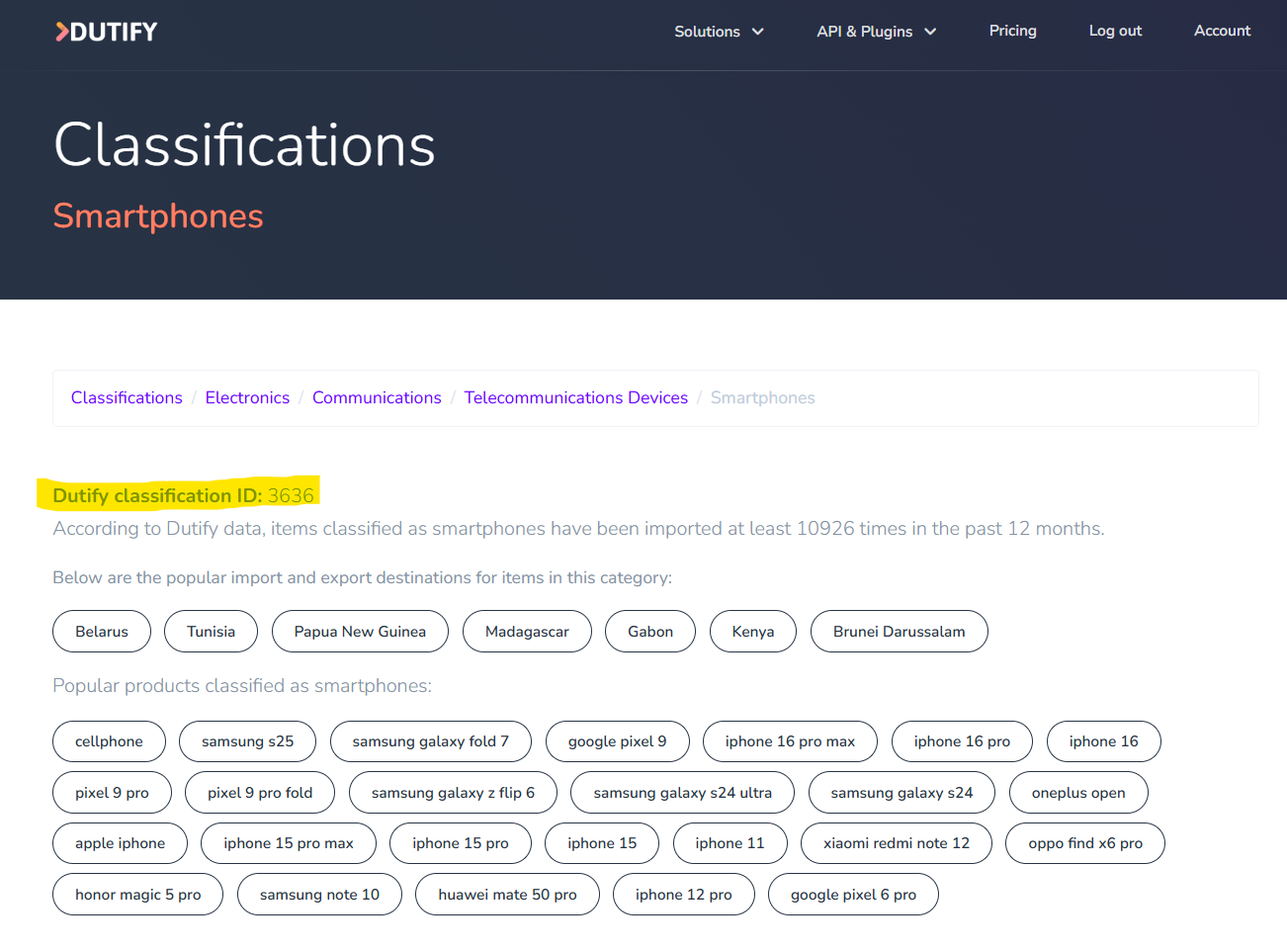

Browse our Classifications tree to find the relevant ID:

-

Or contact us for a full Dutify product taxonomy export in CSV or Excel format.

How do I find HS codes?

HS codes can be found listed within the tariff schedule on a country's customs website. Here are some examples:

Updated 5 months ago